Travel banking fundamentals can be confusing for first-time travelers, especially if they are heading abroad. Using your existing bank can actually cost you an arm-and-a-leg and leave you watching your funds drying up much quicker than expected. Or even worse, there are a number of travel scams and tricks that could be much more devastating, if you don’t take proactive measures to keep your money safe while traveling.

Here’s what I’ve learned about managing my money while traveling over the past few years and what I recommend to all before they set out. Following this guide will help you save money while traveling, to the tune of hundreds of dollars (minimum).

Best Debit Cards for International Travel

As you may know, your bank will often charge you for using another bank’s ATM that is outside of their network. Likewise, the ATM from the other bank you are using will most likely charge you for using a debit card from another bank. This means you will be double charged in order to withdraw money.

And EACH of those fees is usually around $3-5 or more (for your home bank and the out of network bank). What makes this worse, is that in almost all cases it is best to withdraw relatively small amounts of cash each time (a hundred dollars or so) to lessen the blow in case you lose your wallet, get pickpocketed, etc, rather than taking out hundreds of dollars or the max.

In effect, this means you may be paying around $6-10 or the equivalent of six to ten percent per withdrawal of $100 (the percentage goes down if you take out more money at once). Losing that much of your travel fund on a long-term trip will add up to hundreds of dollars in fees over time. No bueno!

So, how can you avoid this budget buster?

If you’re from the US, this is an easy answer.

You need a Charles Schwab Debit Card.

They have no monthly fees, it has a modest APY (interest), includes free checks (but I don’t use checks), and no minimum balances, but… Best of all:

Charles Schwab offers reimbursements at the end of every month for withdrawals of other bank’s ATM fees, anywhere in the world, and they don’t charge withdrawal fees on their end.

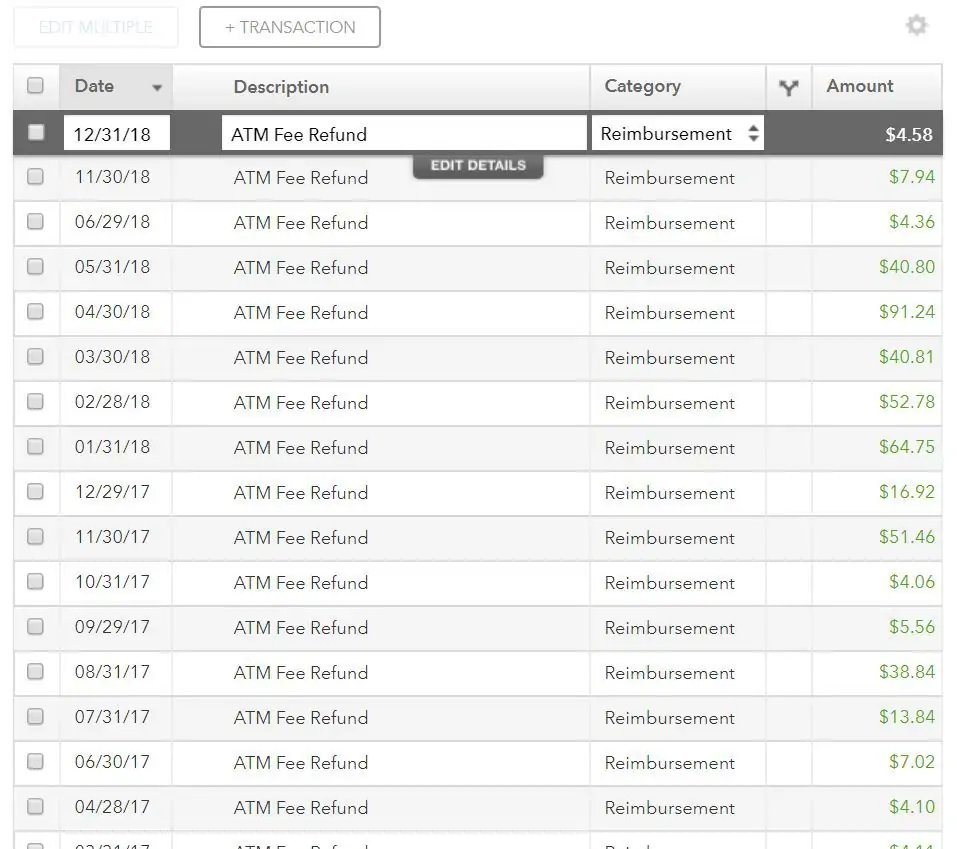

A sample of the money I’ve saved on ATM fees thanks to Charles Schwab.

This means that you can withdraw cash without worrying about those stupid fees adding up, and you can withdraw smaller amounts more regularly (a few times a week or even daily) in order to avoid carrying too much cash with you. I’ve been using the Charles Schwab Checking and Debit Card for years now, and it’s a no-brainer. There are no fees whatsoever, even when it comes to using other banks around the world. It’s a beautiful thing.

You need to get things set up BEFORE leaving the country so be sure to leave a good lead time because the paperwork and process take a little bit of time. Contact them now if you’ve got a trip coming up soon.

If you’re not from the US, you might check out HSBC Checking, which has received positive comments from other international travelers.

Managing Your Banking Accounts

It is dangerous to put all your eggs in one basket.

It is best to keep your money spread out across two or three different bank accounts. Think of them as different buckets that you manage online.

Here’s how I manage my money:

1) Primary Checking Account – This is where I keep my money for paying any bills including recurring non-travel expenses (although this IS where I pay for my travel credit card monthly bills, more on that in a minute).

I do not currently even have a Debit Card for this account, and you should NOT travel with a debit card for this account — either cut it up or leave it safe at home.

I keep my money in a local credit union, which I find to be much better than the big banks.

2) Travel Checking Account – This is the Charles Schwab Checking Account mentioned above. Here is where I keep my cash for travel which I use exclusively for ATM withdrawals (I don’t use this card for any in-store purchases).

You should keep less than $1,000 or so in this account at any given time, so if your card is compromised or stolen, no one could clean you out totally. I generally keep under $500, but it just depends on your cash needs vs. a credit card.

I set up automatic transfers once a month between my primary checking account (1) and this travel checking account so it is always topped off. Be aware that funds can take between 3-5 business days to clear, so if you wait to transfer cash manually when your account is near empty, then you may be left with NO CASH for a few days.

You can clear your funds quicker by initiating the transfer from your primary bank, rather than initiating a withdrawal via Charles Schwab at your primary bank (think push, rather than pull).

Just automate the transfers to go out once or twice a month and that way you will never forget.

3) Primary Savings Account – This is your third and final account where you can keep the majority of your funds isolated away from either of the above. You will set up regular, automated transfers FROM this account if you don’t have the monthly income to cover the expenses in your debit card or primary checking account.

My bank of choice for this is the Capital One savings account, which is free and offers great interest rates compared to my credit union’s savings or the Schwab checking account, so it’s the best place to keep the majority of your money before making any transfers.

What’s great is that a savings account with Capital One 360 includes a checking account with a new debit card, which could be your salvation in emergencies if your Schwab card was lost or stolen. I don’t keep any money in this Capital One checking/debit account, and I’ve set the card to automatically deny a withdrawal when there are insufficient funds (overdraft settings).

Bury this card at the bottom of your pack or somewhere hidden, just in case of emergencies, because they don’t reimburse other ATM fees like Schwab.

Travel Credit Cards

Here we will be talking specifically about using credit cards while traveling or overseas — and not the best travel rewards credit cards (which is a different subject, but check out my Travel Hacking 101 guide — this is how I earn free flights around the world or even free nights at hotels).

In any case, your travel credit card is meant to be used overseas while traveling, so you want to ensure that your credit card has NO foreign transaction fees. If the travel hacking doesn’t appeal to you (ARE YOU CRAZY?), then make sure your card has no annual fee. I use a fee-free Capital One Credit Card for this purpose but much prefer my Chase Sapphire Preferred Credit Card to earn points and miles.

It doesn’t really matter what card you use, but it should meet the following two requirements:

- It is a VISA card (most widely accepted) and

- It has no foreign transaction fees

You MUST set up the card to pay off the balance in full each month in order to avoid any fees whatsoever.

I would recommend making the credit card payment with your primary checking account rather than the Schwab account because separating these accounts ensures you always know how much you need to have to pay for incoming bills and how much cash you have available to take out during your travels. This way you don’t accidentally draw down your single account and then not have enough cash in the ATM or enough money in your account to pay your bills (incurring overdraft fees or other late fees).

I use my travel credit card for virtually any purchases I can (again, I never hand over my debit card to anyone, which could be skimmed) like hotels, gas stations (since I’m road tripping through multiple countries), grocery stores, restaurants, etc.

Credit cards offer favorable exchange rates (always choose to pay in the local currency rather than USD), with no service fees. And in places where carrying lots of cash is a risk, I would recommend putting any and all possible charges on your credit card, plus you can earn points and miles!

Even if there was a fraudulent charge (it hasn’t happened to me yet in oh so many countries), a credit card charge is much easier to refute than with a debit card (although Charles Schwab says they will reimburse fraudulent charges too).

Read More: The Best Travel Credit Cards

In some countries, there aren’t a lot of opportunities to use a travel credit card because cash is still king in most of the world…

Protect Your Cash

Cash is still, more often than not, the main way I pay for things while traveling because it’s accepted everywhere. But you must take proper precautions to keep your cash safe while traveling.

Again, the best way is to withdraw small amounts, more frequently, as mentioned earlier.

Generally speaking, if I’m on the move, I use a money belt to keep my debit and credit cards safe and tucked away, alongside my passport and any cash that I don’t need throughout the day. It’s a peace of mind knowing that your most important items are tucked away and safe.

Previously, rather than a money belt, I’ve made secret pockets inside the lining of my pants — simply by buying an old button-up shirt which also had button closures the pockets (Goodwill for 99 cents!) then cutting out the pockets and affixing them inside my pants.

These work too, but I found that I didn’t use them that often though and just resorted to a decoy wallet which is essentially a wallet with an old driver’s license, an expired credit card, some old grocery store club cards and a little cash.

That way if I was robbed or pickpocketed, they’d get the decoy wallet while my debit card and real cash for the day was simply kept loosely in my front pocket (where it is harder to pickpocket without noticing).

Since then I’ve adopted the old-school money belt which I find to be handier when on the move (you can more easily take out cash or cards, without halfway taking off your pants).

Here’s the money belt I currently use.

I also like to keep at least $100 USD or so in twenties on hand in my money belt as an emergency fund in case I am left without a card, need to exchange money unexpectedly at a border crossing, or for whatever other reason. When I was driving through Latin America, I kept a safe stash can for my emergency money and spare cards.

Trust me, it’s way easier to stash away five individual bills, rather than a stack of 300,000 Colombian pesos (as an example of the equivalent of $100).

I also recommend that you keep another credit card on hand (my backup wasn’t a no foreign transaction fee card, but it could be) which is kept well hidden, just in case of even bigger emergencies, alongside that emergency debit card associated with my Capital One 360 account.

Exchanging Money

I avoid or minimize exchanging money wherever possible.

If you use your debit card at the ATM you will get the best possible exchange rate. If you must exchange money, try and do so with another traveler heading the opposite direction in order to get the best and fairest rate.

I’ll never forget the time I traded over the last of my Bolivian money with an Australian on a bicycle at the edge of one of the most remote border crossings (we had to carry extra gas cans just to cover the distance) in Bolivia.

Normally I always try to spend the last of my local currency on any essentials (or even just candy and snacks) before I make the crossing.

You will get a lousy rate at any exchange kiosk or from those guys walking around serving as an informal border currency exchanger, that is a given.

If you are changing at one of these places, hopefully, it is for a low amount of cash and ALWAYS be aware of the current rate (keep the XE app on your phone). As a rule, be sure to double-check the math on your phone calculator with the rate they quote you (which is going to be lower than the official rate given by XE). Many border tricksters have been known to use a rig the calculator with a formula that skims a percent when they show you the result.

Keeping Track of your Finances

With the earlier tips about trying to manage three different bank accounts, plus a travel credit card, you may think that is just too much to keep track of.

It would be without the added help of Mint.com. Mint is a site that aggregates all your personal finance information across all your accounts — no matter how many checkings, savings, credit cards, or even investment accounts you have.

That way you can always log in and get a great picture of your overall financial health, including tracking any transactions (while also being mindful of any strange or fraudulent transactions) as well as ensuring that your various “buckets” of money are topped off if you need to transfer funds.

I’ve been using Mint for many, many, years and is something I also credit with helping me manage my money in order to set out traveling in the first place. It’s free. Get it, there’s no reason not to.

Tips for Fraud Prevention

Being watchful of your charges and transactions on a weekly basis is step one, but what else can you do?

One, never use a public computer for financial purposes unless it is an absolute emergency.

Two, be cautious of using public wifi networks as well — they are surprisingly easy to hack — whether on your cell phone or laptop.

I use a travel VPN on both my phone and desktop for any sensitive purposes like banking which keeps my connection protected and safe. I’ve used both ExpressVPN and NordVPN if you are looking for a great provider.

Finally, be sure to advise your bank about any upcoming travel plans — it will help them be aware of any fraudulent activity, and it’s super important in order to ensure that your card actually works upon arrival and isn’t blocked by them when you try to make your first transaction.

Travel Banking Fundamentals

So there you have it! I hope you were able to learn something from this comprehensive guide to travel banking fundamentals that should keep your money safe, the fees to an absolute minimum (zero, I hope!), and keep you happily traveling for some time to come.

Click here to check out all of my top budget travel resources so your next trip goes smoothly.

Traveling soon? Book your lodging on Booking.com now to save, or if you plan to stay longer, I highly recommend looking for a place on Airbnb. And don’t forget to purchase international travel insurance that will help protect you against illness, injury, and theft. I use and recommend World Nomads for its combination of coverage and affordability.

Read Next: Using Travel Credit Cards for Free Nights at Luxury Hotels

Share This

Did you enjoy this post about travel banking fundamentals? Please take a moment to share it on Facebook, Pinterest, or Twitter.

Ryan

Latest posts by Ryan (see all)

- Kazakhstan Food: Exploring Some of its Most Delicious Dishes - August 7, 2023

- A Self-Guided Tour of Kennedy Space Center: 1-Day Itinerary - August 2, 2022

- Fairfield by Marriott Medellin Sabaneta: Affordable and Upscale - July 25, 2022

- One of the Coolest Places to Stay in Clarksdale MS: Travelers Hotel - June 14, 2022

- Space 220 Restaurant: Out-of-This-World Dining at Disney’s EPCOT - May 31, 2022

Comments 4

Never thought about a decoy wallet, that will probably save me some nerves hahaha. Is financial fraud the only reason you use vpn’s? Because I’ve used nordvpn in so many scenarios I should write a blog too (if I could probably I would haha) I’ve been saved by it numerous times as facebook/whatsapp are blocked and I use both for work, with a vpn I could use both. Of course, I totally agree about public wifi as that is REALLY easy to hack

I’m pretty glad that I decided to start using VPN services, especially while traveling. I recently learned that using public wifi is not safe since you become more susceptible to hacks, which is why you shouldn’t expose any of your login or other sensitive information such as bank details. I found this website where they talk about how you can increase your safety while shopping online, but I’m pretty sure that some of the points can be adapted to when you’re traveling and want to keep your bank details safe. Here are the tips: https://medium.com/@kevin.goddlerdon/safe-online-shopping-92b440f498e

Hi Ryan,

Another question for you. Why the Capital One 360 instead of the Citibank Accerate savings with the higher APY ? Was there an advantage to The 360

Thanks

Author

That’s another valid choice, after taking a quick look. I just have had the CapOne account for many, many years — I’m not totally familiar with Citi’s overall banking packages, so just be sure to take a closer look at any account service fees, etc.